NAII - Nasdaq - Natural Alternatives International, Inc.

NAII - Natural Alternatives International, Inc.

Natural Alternatives International, Inc. engages in formulating, manufacturing, and marketing nutritional supplements such as vitamins, minerals, herbal, and other nutritional supplements, as well as other health care products in the United States, Europe, Australia, Asia, Mexico, and Canada.

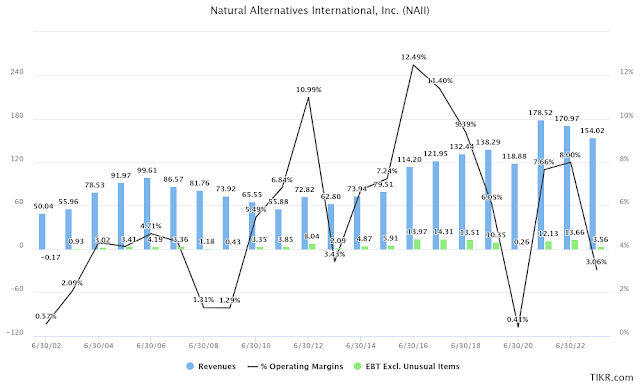

The chart shows revenues in blue, operating margins as a line (not that great as max is 12.5% and average is probably at aroudn 4% or so), and EBIT excl. unusual items.

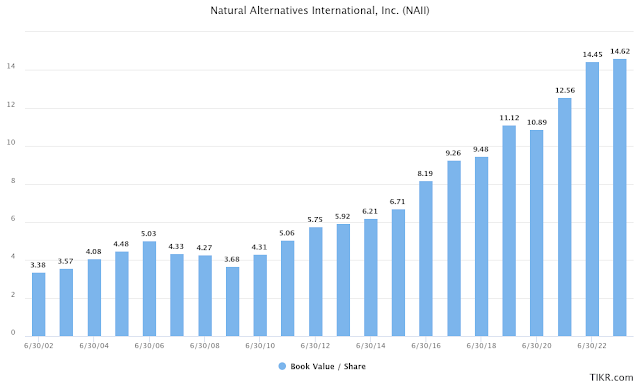

The chart shows a growth of equity with compound annual growth rate of ~8%.

There are 6M shares outstanding. Due to share repurchases, this amount has been lowered in the last 5 years from 7.5M (2018 10-K). Additional paid-in capital stands at $31.4M, while retained earnings stand at $80.1M which suggests good profitability and use of capital.

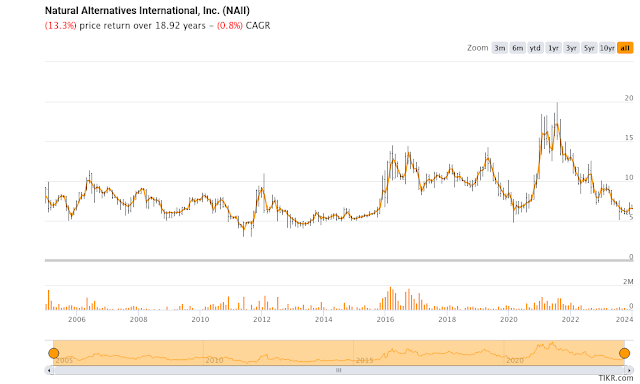

For this company, the equity value and the stock price aren't very in tune. It seems like it follows the last year margins more or less, which have been low for 2023 at 3% vs 8% one year ago.

NAII serves primarily 3 customers for manufacturing the supplements. All in all, this company seems to be doing good. Balance sheet is strong with a book value of $88.8M and cash of $16.7M vs no credit facility. Current ratio is 3.6x and quick ratio is 1.32x. Current market capitalization is $40M and share price is $6.61. I purchased this stock for $6.4 a month or so ago. I wouldn't sell for less than a double of my investment, and I consider this a good investment based on the analysis done so far.

The CEO, who has been a director since 1986, owns directly and indirectly 0.7M shares (Form 4, SEC), which represents almost 12% of the common shares outstanding.